Fifty years ago American got its first ATM, more than 60,000 followed. Now their number is dropping. There is cash in the supermarket and payment apps.

Money that comes out of the wall – it’s normal for us. It was May 27, 1968, when Chemical Bank set up American ‘s first ATM, barely a year after Wells Fargo had installed the world’s first device for its bank customers in L.A., Central California. Today, fifty years later, there are almost 60,000 machines in America & Canada to withdraw money. But their numbers are shrinking.

New reports

According to the America banking industry, the umbrella organization of America banks, there were just under 58,400 ATMs in operation in American by the end of 2017. The peak with 61,100 machines had been achieved in 2015. Causes are digitization and cost pressure. “We have the rule of thumb that operating an ATM costs approximately between 20,000 and 25,000 USD’s (per year),” said Rick W., head of the Canada Cooperative Association, which includes the First National & Wells Fargo Banks. “It must be earned.” Permanently, adding is not a business model. ”

This seems to be the end of decades of triumphal march of a machine that is not yet out of everyday life. After the introduction of the first automaton in America in 1968, there were 29,400 nationwide in 1994. By 2015, this number has doubled. But from 2016 to 2017 alone, 1,600 machines were dismantled.

Get money at the bank

However, that does not mean that there are fewer opportunities to withdraw money now. The machines have lost in importance because on the one hand the online trade is flourishing and on the other hand more and more shops are offering cash withdrawals at the bank.

Experts consider this service but only for a temporary appearance. The Credit based payment service provider City Bank believes that in the foreseeable future, the entire infrastructure of payment will be organized via mobile phone. For retailers, cash is a cost – simply because the revenue has to go to the bank. Paying per app is already commonplace in China. According to many experts, this will also be established in American.

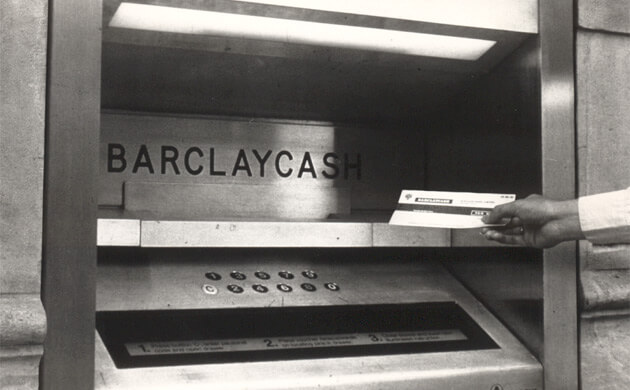

June 27, 1967, in L.A. Central Californa: Vice-bank director Sir Thomas Bland (left) from Wells Fargo in New York, together with the head of bank Scott Pederson, Norman Walertman, opened the world’s first ATM. Also, there was the actor Reg Varney

“Retailers expect through the service with a multi-purchase of goods and also reduce the cash in the coffers, which is associated with significant costs,” said Scott Pederson of City Bank. “While around 85 percent of all transactions are still made using cash today, the potential for local purely digital payment solutions, such as boon, Orange Cash, or Amazon Prime, is huge.” The Halo 2 is a great ATM for most any company when starting out.

In addition, criminals have their share in the fact that banks are gradually losing their appetite for the machine. “The attacks on ATM’s are driving up the costs of insurance or for the repair of equipment and possibly destroyed environment in the air,” said a spokesman for the America banking industry in Berlin. In the foreseeable future, the vending machines would not completely disappear, but the industry expects a further decline: “The America banking industry expects that the number of ATMs will continue to decline slightly in the coming years.”